The investing data provided on this web page is for educational functions. NerdWallet, Inc. no longer offers advisory or brokerage offerings, nor does it endorse or advise investors to buy or promote precise shares, securities, or unique investments.

Money market money owed offered through banks is federally insured via the Federal Deposit Insurance Corp., as much as at least $250,000 within the occasion of a financial group failure.

Failures are uncommon. However, the economic group collapsed in 2023, a reminder of FDIC insurance’s significance in shielding your finances.

Money marketplace payments (MMAs) are a monetary monetary savings account that now and again comes with the functionality to put in writing assessments or use a debit card. Though MMAs are federally insured, they shouldn’t be harassed with coins marketplace mutual rate variety, which can be investments and no longer federally insured.

Read more directly to examine how your deposits are blanketed and how MMAs look at exceptional economic monetary savings alternatives, which embody mutual price range.

However, cash market money owed has some realistic drawbacks.

Like financial savings, cash marketplace money owed generally encompasses transaction limits. In the past, coins market account holders were limited to 6 monthly handy withdrawals or transfers. This method allows you to make an entire of six debits, take a look at, or make virtual transfers each month (e.g., moving coins for your financial institution account or paying an invoice).

In April 2020, the Federal Reserve issued an intervening time rule that lifted the six-transaction restriction on monetary financial savings deposit withdrawals (there is no expiration date for this period in-between rule as of January 2023). However, your economic organization or credit score union can hold the six-withdrawal limit and rate a charge if you exceed it. Speak together with your economic enterprise before setting up a coins market account to confirm the account’s transaction limits and fees meet your desires.

While cash market money owed offers better interest expenses than regular checking and financial savings payments, the ones with higher fees consist of a caveat. Money market money owed will be inclined to have better setting out balance necessities than a modern-day checking or financial savings account, a few as immoderate as $25,000. Some customers may additionally find the account minimums that need to be fulfilled.

Accessing Full FDIC Insurance for Money Market Accounts

Since FDIC insurance limits align with the group, you may open coin market payments with several banks to acquire complete safety. However, this will be a complex and time-eating device.

Consider a business organization with $10 million in cash. It would possibly need payments at 40 perfect banks – with $250,000 every – to benefit entire FDIC coverage. That’s 40 relationships to govern, statements to reconcile, and hobby expenses to reveal. It may take a whole group to control that corporation’s cash. Fortunately, a much less complex way to get the right of entry to complete protection is possible.

Money Market Accounts vs. Money Market Funds

It’s critical to differentiate among coins marketplace debts and cash market price range, which sound equal but have exceptional developments and are regulated in any other case.

Money marketplace account: A money marketplace account is a shape of deposit account, typically furnished using banks and credit score unions. These bills offer blessings with earned interest, test-writing competencies, and insured deposits.

Money market fund: Money market budgets are a particular form of mutual fund you should buy via a brokerage organization or mutual fund commercial enterprise employer. These budgets invest in property so that they may not be federally insured.

Coin marketplace payments are insured deposit debts, while cash marketplace price ranges are funded products without federal insurance.

FDIC Insurance Coverage Example

Say that you have a checking account, financial savings debts, and a certificate of deposit (CD) account in the equal monetary group. All of them are on your name and characteristic of the subsequent balances:

- Checking: $four, two hundred

- Savings: $2,000

- Savings: $10,000

- CD: $a hundred seventy-five,000

In Universal, you have been given $191 hundred across those four payments. Since this is much less than the FDIC coverage maximum of $250,000, all of your coins are covered within the now, not in all likelihood occasion of failure.

Now, say that you have $275,000 in your CD account as an alternative, developing your expected balance to $291 two hundred. In this case, $250,000 is covered via the FDIC, but $forty 200 is uninsured.

Keep in mind that insurance is performed consistently with the owner. An unmarried owner is blanketed as much as $250,000, but joint bank money owed may be eligible for coverage past this.

Money Market Accounts

Money marketplace money owed (MMAs) are deposits that may be opened at banks or other monetary institutions like credit rating unions. They act like a checking-savings account hybrid, imparting each the electricity of a checking account with the hobby-bearing functions of a monetary economic savings account.

They encompass financial institution account capabilities, which means you can write tests, make transfers among money owed, and behavior debit card transactions—as plenty as a positive restriction. Federal recommendations restrict them to 6 steadies per month; after that, you’re charged an issuer charge. Three

Money market bills, moreover, offer better interest expenses than preferred checking or monetary savings bills. This makes them an exquisite alternative for folks who need to hold for an awesome rate, like a holiday.

Most economic institutions require deposit minimums for maximum cash marketplace payments. For example, Bank A can also require you to open an account with a minimal balance of $25,000. You also may be required to hold that stability each month. You could be charged a monthly price if you dip below that amount.

What is a coins market account?

A cash marketplace account is a type of account furnished by banks and credit score rating unions. Like unique deposit payments, coins marketplace money owed is insured with the beneficial, valuable resource of the FDIC or NCUA, such as $250,000 held with the useful resource of the equal owner or proprietors.

Money market bills commonly tend to pay you higher hobby costs than unique forms of financial savings money owed. On the other hand, coins market money owed commonly limits the number of transactions you could make through test, debit card, or virtual switch. Usually, you can make endless withdrawals and payments through an ATM or by making the withdrawal in person, via mail, or with a cell phone. A cash market account should require a minimum amount to be deposited.

If you have more than one bill with a monetary institution or credit score union, speak in your economic organization or credit score union to affirm your FDIC or NCUA insurance coverage.

What is deposit insurance?

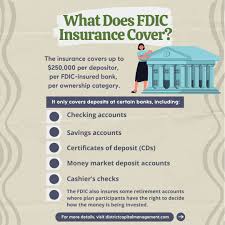

A: FDIC deposit coverage protects monetary organization customers if an FDIC-insured depository company fails. Bank clients don’t need to buy deposit coverage; it’s miles automated for any deposit account opened at an FDIC-insured financial organization. Deposits are insured as a whole lot, at least $250,000, in line with the depositor, in step with FDIC-insured monetary organization, and step with possession class.

Deposit insurance is calculated greenback-for-dollar, fundamental plus any interest collected or because of the depositor via the default date. For example, if a patron had a CD account in her call on my own with prime stability of $195,000 and $three 000 in accrued interest, the entire $198,000 is probably insured.

Are Money Market Accounts FDIC-Insured?

Yes, coin marketplace debts obtain FDIC coverage as much as the felony restriction of $250,000. Note that this limit applies on a step with-depositor, steady with account elegance, and in step with financial institution foundation.

If your standard balances, in particular, account for training at an advantageous monetary organization, ever obtain better than this limit, handiest the primary $250,000 and acquire FDIC insurance for every man or woman. These instructions include single bills, joint money owed, believed debts, enterprise payments, and additional. Note that those do not always delineate among economic, financial savings, checking, or money market bills, but instead with the valuable aid of account ownership popularity.

What money owed is not insured?

According to the FDIC, various non-deposit investment merchandise aren’t insured through the FDIC, no matter the truth that they were supplied from an insured bank or credit rating union. These encompass:

- Stock investments

- Bond investments

- Mutual finances

- Crypto Assets

- Life coverage rules

- Annuities

- Municipal Securities

- Safe deposit bins or their contents