Asian Mobile Account (AMA) platform is an innovative initiative undertaken by way of the use of way of State Bank of Pakistan (SBP) and Pakistan Telecommunication Authority (PTA), in collaboration with branchless banking (BB) corporations, telecom operators, and certainly one of a type improvement companions. The AMA platform has been launched beneath the National Financial Inclusion Strategy (NFIS). It desires to facilitate elegant hundreds, particularly the low earnings segments, to digitally open their BB money owed and use the available monetary services quickly, easily, and cheaply.

Simplicity At Its Best

An easy monetary group accounts for people with minimum transactional necessities, allowing you to fulfill your easy banking goals.

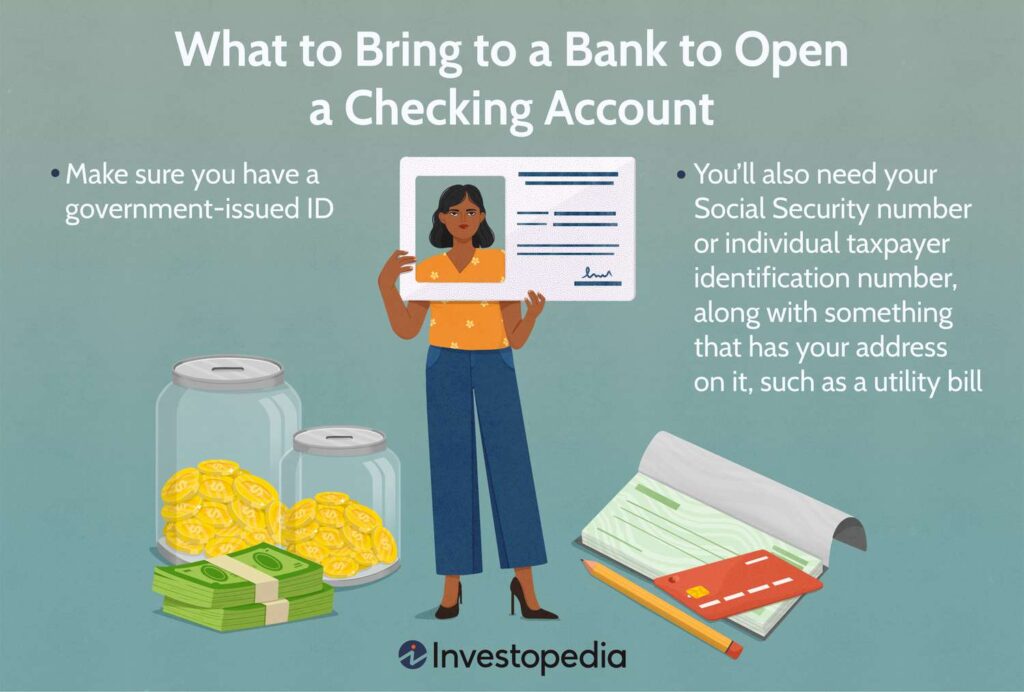

What You Need To Open a Bank Account

When you open a modern-day monetary organization account, you should offer the bank or credit score rating union documentation so we can verify your turn out to be aware of.

For Customers with Limited Proof of Source of Income

The Riba-unfastened Meezan Asaan Current Account is every other addition to the services of the Meezan Monetary Group. Meezan Asaan Account opens the doorways of banking services and products to clients who need more evidence in the supply of profits. The account may be opened with simply Rs. One hundred/- and a legitimate CNIC/ SNIC / Passport / National Identity Card for Overseas Pakistanis (NICOP) / Pakistan Origin Card (POC) / Alien Registration Card (ARC) issued by using the usage of the National Aliens Registration Authority (NARA) / Pension Book.

(Meezan Aslan’s Current Account is supposed for resident humans having Pakistani nationality)

Pakistan Digital Account

Open your financial institution account without going to the economic organization and avail yourself of interesting discounts.

ABL brings a remarkable luxury to residents of Pakistan by imparting online accounts in the facility. Every proud Pakistani can effortlessly open a Pakistan Digital Account from anywhere on every occasion without touring a branch. Instantly open your Asaan Digital Account (ADA), Asaan Digital Remittances Account (ADRA), Freelancer Digital Account (FDA), Saving, and Current payments on the Allied Bank internet site or myABL Digital Banking and preserve playing a wide variety of interesting gives with nearby and remote places forex debit cards.

AL Habib Digital Account

Banking made Convenient

Whatever your needs, we have an account to help you find a financial agency your way!

We purpose to offer you a continuing digital account commencing experience. AL Habib Digital Account’s goals are to redefine your account and begin reviving it by making the system clean and high-quality.

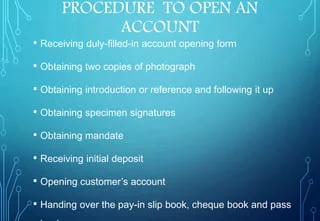

Account Opening Formalities

Please evaluate the documents required to open an account with Askari Bank. The Turn Around Time (TAT) and Procedure are also given for your reference.

Location and Accessibility:

Consider the financial company’s bcompany’sces and ATMs. Is there a department close to your home or place of work? Do they have an extensive ATM community? Accessibility is vital to your comfort;

Fees:

Different banks have various price structures. Look out for month-to-month maintenance prices, ATM charges, overdraft fees, and every payment associated with the account. Some financial establishments make sure price waivers are based totally on factors like minimal balances or account hobby;

Interest Rates and APY:

If you’re considering a financial savings or coins marketplace account, take note of the interest fees provided. Annual Percentage Yield (APY) is an important metric to study because it shows the general decrease returned you may anticipate in your deposit;

Service Level:

Check for offerings provided by the financial organization to decorate your banking experience. Mobile apps, functional online banking, and green customer service are all useful gear in this case.

Login through NetBanking or MobileBanking to start transacting

You can use your account once you get your customer ID and account range. Get commenced out by logging into NetBanking and MobileBanking and growing a password.

HDFC Bank strives to decorate its customers by supplying secure and handy virtual services, and InstaAccount is yet another imparting to live as much as this promise. With HDFC Bank InstaAccount, you can open a savings account properly and in a few clean steps.

Product Features & Benefits

- Account may be opened with a preliminary deposit of Rs. 1,000/- best

- No minimal balance safety costs

- Unlimited complimentary withdrawals through Faysal Bank ATMs.

- Two loose deposits and a few free withdrawals are consistent with the month through coins/clearing.

- In case of extra transactions, costs as regular with the Schedule of Charges are relevant.

- Free Annual Statement of Account. For standard expenses, consider if a couple of declarations are required.

- Service Charges are as consistent with Faysal Bank’s ScheBank’sf Charges.

- Visa Debit Card and Barkat UnionPay Card

- World and Country sizable Acceptance

- Instant charge range transfer

- Balance Inquiry

- Utility Bill Payment

- SMS Alert

- 24-Hour Customer Service

- Three Supplementary Cards

- Flexibility of linking up to 10 money owed for coins withdrawal.

Have the subsequent gadgets ready:

An authorities-issued ID (together with a reason stress’s listress’sassport, or military ID)

Your identity variety

Proof of your bodily and mailing deal with

An initial deposit (if required)

If you don’t have a government-issued ID, you can use a few distinctive forms of ID. Ask your financial employer what different varieties of identification it could acquire.

Depending on your situation, your identity range may be your Social Security quantity, alien identity card wide range, Individual Tax Payer Identification Number, or some other authorities-issued ID amount. If you’re a Unyou’retates citizen, your identification variety is in your Social Security range.

You’ll learn these statistics in a few shapes, whether you’re starting an account online or individually.